Bank of Russia speeds up gold purchases

- дата: 15 сентября 2010 (источник)

Author: Stepan Vorobiev, www.goldenfront.ru – First Russian gold investment portal, contacts: db@goldenfront.ru

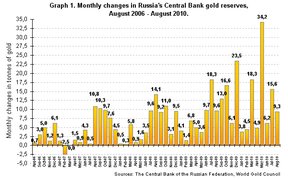

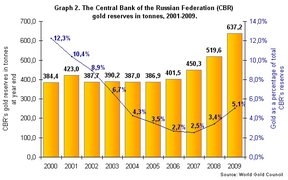

The Central bank of Russia (CBR) sticks closely to its long-term gold buying strategy. Most recent data clearly illustrates this. CBR counted 734 metric tons of gold in its reserves (1) as of August this year. CBR added 9.6 tons of gold to its reserves in August and it became 41st month in a row of this epic Russian gold buying spree which began in April 2007 (see graph 1). In the first eight months of 2010 CBR’s gold stash grew by 96.7 tons or 15,2%, while the share of yellow metal in its reserves rose from 5.1% to 6.1%.

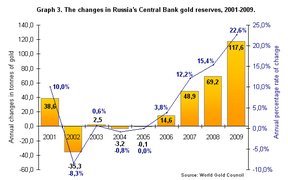

CBR publicly declared the intention to increase the share of gold in its reserves to 10% in the fall of 2005(2). The Bank has begun to realize this plan in 2006 in a stealth manner thus avoiding excessive publicity. Since then, CBR has been constantly increasing both volume and growth rate of its gold purchases (see graphs 1 and 3), stepping up the activity significantly after the start of the US mortgage crisis in 2007 (see graph 1).

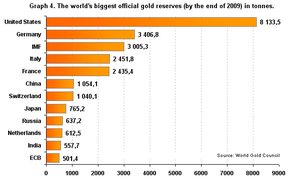

In 2009 CBR’s gold holdings grew record 117.6 tons or 22.6%, reaching 637.2 tons by the end of the year. As a result Russia’s gold reserves outstripped those of the Netherlands in 2009 and rose one step in the gold ownership rankings of countries and international financial institutions – from 10th to 9th position. The US still rules the roost with its 8.133.5 tons.

The share of gold in CBR’s overall reserves stood only at 5.1% at the beginning of 2010. Other countries with the largest FX reserves are in a similar position. According to World Gold Council China’s reserves contain a tiny 1.5% of gold, Japan’s – 2.6%, India’s – 6.9%, South Korea’s – 0.2% and those of Brazil– 0.5% as of the beginning of 2010. This stands in stark contrast with the US – 70.4%, Germany – 66.5%, France – 64.6%, and the UK – 16.3%.

CBR’s gold policy follows the global trend. Central banks either diversify out of the dollar and buy gold instead thus increasing its share in their huge FX holdings (China, India) or restrict and stop their gold sales (developed world). As a result Central banks have become net buyers rather than net sellers of gold from the second quarter of 2009 and on – for the first time in nearly twenty years.

It should be noted that 2010 has seen sharp increases in CBR’s gold buying despite the seemingly improving global economic situation. For example, in May its gold holdings grew by impressive 34.2 tons, which exceeded the volume of purchases for the entire first half of 2009. CBR more than doubled its gold purchases from the first half of 2009 to the same period 2010, from 30.6 to 71.8 tons. The sovereign debt crisis in the eurozone which peaked in May could partially explain this aggressive buying behavior.

Notes:

- CBR’s gold reserves should not be confused with the Russian state gold reserves of which they are a part. The Russian state gold reserves also include the metal in the Gokhran of Russia (state precious metal storage facilities) – an adjunct of the Russian Ministry of Finance. In contrast with stats on CBR’s gold reserves information regarding the size of gold holdings in Gokhran is a state secret. Therefore, official global gold reserves statistics published by IMF and WGC do not include gold kept in Gokhran. This accounting peculiarity is used by several other countries.

- CBR’s announcement was made after the meeting of gold producers in the city of Magadan, Russian Far East in November, 2005 where the then Russian president Putin proposed to increase the share of gold in the Russian state reserves. Presidential economic advisor Andrey Bykov took part in Gold Rush 21 Conference in Dawson City, Yukon, Canada organized by GATA in August 2005 not long before Putin’s proposal. According to GATA’s head Bill Murphy, at the end of the event Bykov told him it had been the finest conference he ever attended.

Комментарии 0

Добавить комментарийПожалуйста, войдите или зарегистрируйтесь, чтобы оставить комментарий.